- ← The rise and fall of production and consumption

- Major U.S. military operations/actions to protect oil →

The marketplace of oil

Energy security is not a military operation issue … it’s a market-centered subject.

- Michael Rühle, Head of Energy Security Section, NATO

When the public thinks of ensuring energy security, they may think of military combat and defense of physical infrastructure crucial for producing or shipping petroleum. In reality, such military operations are rarely required. Rather, the global marketplace is the main stage for regulating energy security through pricing, production levels, and trade between nations. The market determines how much oil is available, how much it costs, and where it can be shipped to. As a result, energy security, defined as ready access to energy at affordable prices, is dependent on the international oil market.

Players in the global oil trade include international oil and gas corporations, such as Exxon Mobil Corporation, as well as state-run enterprises, such as Saudi Aramco Oil Company of Saudi Arabia. In the latter case, governments have a key voice in determining the operations of the company, which are focused on strategic national interests rather than maximizing profits.

The military does play a key role in maintaining the peace and stability in regions necessary for the free trade of oil. But as long as the market is allowed to function normally, global energy security is ensured by the decisions and operations of the oil companies themselves.

So who are these corporate movers of the world’s energy?

Oil companies run the gamut from a few hundred employees to tens of thousands; production capacities from a few thousand barrels per day to tens of millions; and from wholly state owned and run to private, for-profits. The most influential of them can be grouped into three categories:

International oil companies (IOC) – Private companies that operate internationally and independently of national interests. IOCs are profit-driven and have to answer to shareholders. Examples include Exxon Mobil, Royal Dutch Shell and BP (formerly British Petroleum).

National oil companies (NOC) – State-owned companies that primarily operate within national borders and according to national interests. The OPEC countries and some non-OPEC countries run national oil companies, and use the revenue stream as a significant source of funding for their governments. Examples include Saudi Aramco and Petroleos Mexicanos (PEMEX).

NOCs that operate like IOCs – State-owned companies that are market-oriented and operate with a corporate strategy, while acknowledging the objectives of their country. Examples include Petrobras of Brazil, Statoil of Norway.

How big are these oil companies?

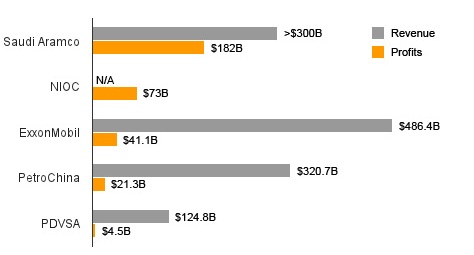

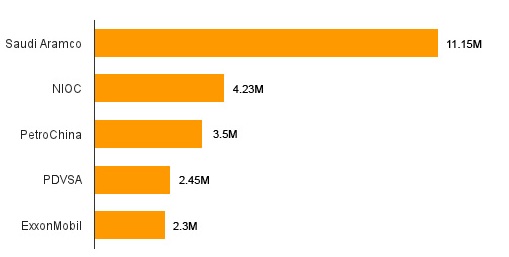

State-run NOCs are, in general, much larger than IOCs. Saudi Aramco, the largest of the NOCs and overall, earns over $1 billion in daily revenue according to Forbes, with estimates of annual profit usually north of $180 billion . It had an average production of 11.15 million barrels of oil a day in 2011, according to the CIA World Factbook. By comparison, Exxon Mobil, the largest of the IOCs, brought in $41.1 billion in profits and produced an average of 2.3 million barrels a day.

Oil Company Revenue and Profits, 2010-2011

Daily Average Oil Production, 2011 (barrels per day)

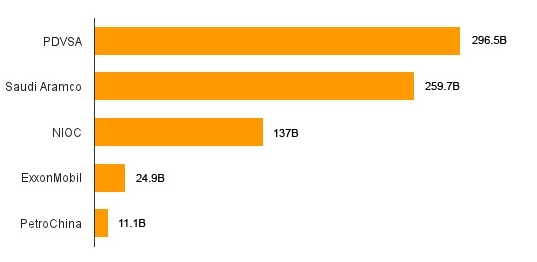

Proven Reserves, 2011 (barrels)

Below are the production and revenue statistics for five of the largest oil companies: Saudi Aramco (NOC, Saudi Arabia), National Iranian Oil Company (NOC, Iran), Exxon Mobil (IOC, United States), Petroleos de Venezuela, South America (NOC, Venezuela), and PetroChina (Public subsidiary of China National Petroleum Corporation, NOC, China).

Saudi Aramco does not disclose its actual revenue results, so these numbers are estimates. However, Saudi Aramco is widely known to be the most profitable company in the world, owing to the ease of its access to the kingdom’s vast petroleum reserves.

Saudi Oil Minister Ali al-Naimi remarked in 2008 that the cost of producing a barrel of Saudi oil was likely less than $2, compared with an average $10-$15 in the U.S. Meanwhile, the selling price has fluctuated from $80 to over $100 per barrel.

Production targets, especially those set by the Organization of the Petroleum Exporting Countries (OPEC), are a key influence on the price of oil. OPEC member countries are net oil exporters, and export about 60% of the world’s oil.

Crude oil prices have historically increased when OPEC lowered their production targets, which they have done intentionally at times to keep prices — and profits – up. Member countries do not always comply with OPEC production targets, which also impacts oil prices. The OPEC member countries are: Saudi Arabia, Venezuela, Iran, Iraq, United Arab Emirates, Qatar, Kuwait, Nigeria, Libya, Ecuador, Angola, and Algeria.

Venezuela surpassed Saudi Arabia in 2010 as the country with the world’s largest proven reserves, at 296.5 billion barrels. However, much of these newly proven reserves are in hard-to-access sources. Saudi Arabia’s reserves, by contrast, are largely liquid and easily accessible.

Where do these oil companies operate?

To get a sense of where oil companies operate, we’ve profiled two companies: the largest NOC and the largest IOC. They come from two of the top oil-producing countries in the world: Saudi Arabia and the United States.

A look at a national oil company: Saudi Aramco Oil Company

Saudi Aramco, headquartered in Dhahran, is the largest oil company in the world and Saudi Arabia’s national oil company. It holds approximately one-fifth of the world’s proven conventional oil reserves, spread out over about 100 oil and gas fields, including eight “super-giant” fields, in the kingdom.

Eighty-three percent of Saudi Aramco’s oil production is of premium light grades, as reported by Saudi Aramco in 2009. By contrast, over 100 billion barrels of Venezuela’s proven reserves are in extra-heavy crude oil and bitumen deposits, which are harder and more expensive to extract. Canada, the third-largest holder of proven reserves, holds 170 billion barrels, or 98%, of its reserves in heavy oil sands. Because of this, Saudi Arabia still produces the most oil in the world by a wide margin.

International oil company: Exxon Mobil Corporation

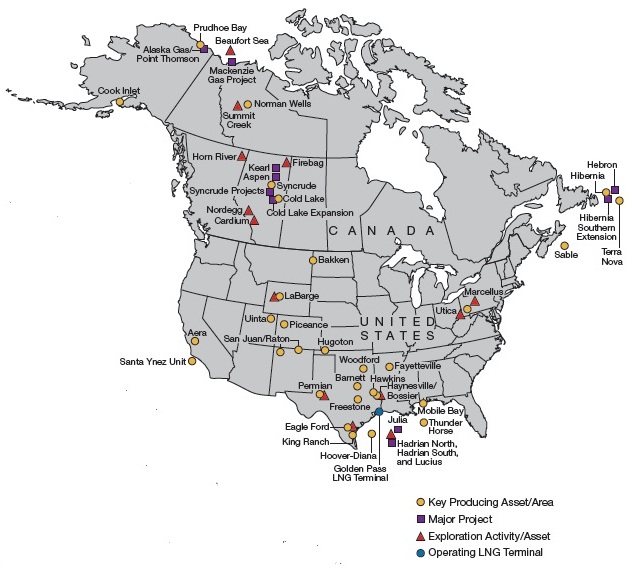

Exxon Mobil, based in Irving, TX, is the largest of the world’s public multinational oil companies. As a public multinational company, it operates worldwide, unlike Saudi Aramco, which focuses its operations in Saudi Arabia.

Map tiles by Stamen Design, under CC BY 3.0. Data by OpenStreetMap, under CC BY SA.

Exxon Mobil operations in North and South America

Oil companies are constantly involved in exploration to replenish their reserves. Last year Exxon Mobil added 2 billion oil-equivalent barrels to its proven oil and gas reserves, replacing 116% of production for the year.Their activities include partnering up with Rosneft, Russia’s biggest oil company, to jointly develop 31 million acres in the Kara Sea north of Siberia. They also made a significant discovery in the Gulf of Mexico Hadrian complex, bringing their total estimated recoverable resources in the area to over 700 million oil-equivalent barrels.

Maps: Exxon Mobil 2011 Financial and Operating Review.