L-3’s 2012 annual profit has fallen 23 percent from a year ago due to a higher income-tax bill.

Ashley Lapin/MEDILL

(ARTICLE ORIGINALLY PUBLISHED JAN. 30, 2013 ON MEDILL REPORTS CHICAGO)

Defense contractor L-3 Communications Holdings Inc., helped by solid demand across key product lines, turned in stronger-than-expected fourth-quarter results Wednesday.

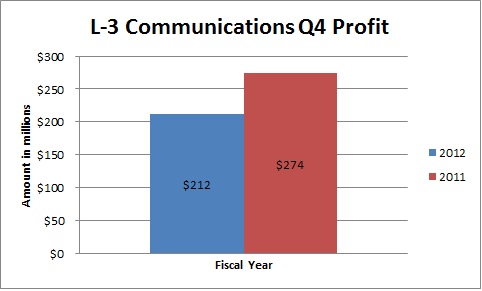

In the latest quarter, net income dropped 23 percent $212 million or $2.25 per diluted share, from $274 million or $2.72 per diluted share in last year’s quarter. In the year-ago quarter, however, L-3 was the beneficiary of a dramatically lower income-tax bill.

Sales inched up to $3.56 billion from $3.54 billion a year ago.

New York-based L-3 provides the U.S. government and other customers with aircraft-maintenance services, and also offers cyber-security and intelligence-related services. Because the Department of Defense is such a big customer, L-3 – like other defense contractors – is under a shadow because budget negotiations have to date not yielded an agreement; if an accord isn’t reached, the government is obliged to implement big cuts in its defense contractors beginning March 1.

“Overall, we had a solid fourth quarter, underscored by strong orders, sales and cash flows, in spite of the challenges and uncertainty in the U.S. defense budget,” said Chairman and CEO Michael T. Strianese.

The latest quarter’s $2.25 per share in earnings topped the $2.12 analysts surveyed by Yahoo Finance had been expecting. Per-share results got a boost because fewer shares are outstanding: thanks to an ambitious share-repurchase plan, L-3 now has reduced its shares outstanding by 6.5 percent.

In New York Stock Exchange trading Wednesday, L-3 shares rose 22 cents to close at $78.11.

During the company’s conference call with analysts, questions centered around the upcoming “sequestration,” the formal term for the budget cuts to take place on the March 1 doomsday. Chief Financial Officer Ralph G. D’Ambrosio said the company can’t provide any guidance until the situation clarifies.

L-3 “reported a good quarter,” said CRT Capital Group analyst Brian Ruttenbur. Noting that the company hasn’t factored in any effects from the potential sequestration in its guidance, he said, L-3’s “outlook is a bit rosy.”

L-3 isn’t unaware of the disruption such budget cuts would create. “What we do know is that the prospect of sequestration remains a major concern for the nation, the defense industry and L-3,” CEO Strianese said. “More than two million American jobs are at risk. Put simply, indiscriminate budget cuts would put our national security in jeopardy” and threaten the defense sector, he said.

L-3’s net income for full-year 2012 was $810 million or $8.30 per diluted share, down from the prior year’s $954 million or $9.03 per share. Net sales for FY12 were $13.15 billion, slightly lower than net sales of , $13.16 billion in 2011.