WASHINGTON — A recent study published by the Center for Strategic and International Studies found that the number of Air Force contracts that were awarded after competitive bidding had dropped by one third, while the other services didn’t experience the problem. And the think tank could find no reason for the decline.

Even in 2008 the number of competed contracts for Air Force services was less than those of either the Navy or Army and has only fallen since.

The CSIS researchers suggested that policymakers determine whether the decline is caused by issues inside the Air Force or external forces.

“Given the strong emphasis on promoting effective competition in DOD contracting from DOD and congressional policymakers, as well as prominent officials within the Air Force, the real decline in competition for Air Force services contracts calls for increased attention and scrutiny,” the report said, calling it a “possible warning sign.”

The study used data from the Federal Procurement Data System to analyze why the Air Force continues losing ground in competition for contracts in this “period of significant policy focus on services acquisition.” Several compelling possible explanations for this fell short of explaining the situation. The study found that “shifts in the mix of services within the Air Force’s services contracting portfolio are not the primary driver of the decline in effective competition” and also that the Air Force’s enforcement of DOD plans to reduce obligations for service contracts did not explain the low numbers.

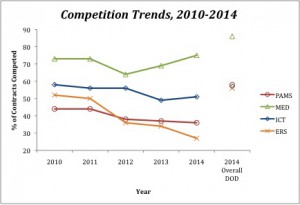

Of particular interest was an analysis of individual service categories within the Air Force’s portfolio of services. Of the various service categories, rates of effective competition for contracts management support services and equipment-related services declined the most sharply. The remaining categories, facilities-related services and construction, information and communications technology services and medical services were less affected.

Contracts management and equipment-related services are the two biggest service categories for the Air Force. Though tempting to assume that sharp declines in number of competed contracts in the largest categories could be indicative of infrastructural viability, the study found this not to be the case. Data actually showed increases in contract obligations awarded without effective competition for both of those types of services. The report considered category specific reasons that could contribute to this trend and found them insufficient as explanations. “Particularly for [equipment-related services], most maintenance and repair for major aircraft platforms and systems will end up being performed by the original developer/manufacturer, for reasons including ownership of technical data rights. With that said, even accounting for the limitation on competition for some services related to aircraft, the low and declining rate of effective competition for Air Force services is noteworthy,” the report stated. The Air Force spokesperson did not return requests for a comment.